Moving on from IR35 irritation, to action

Background

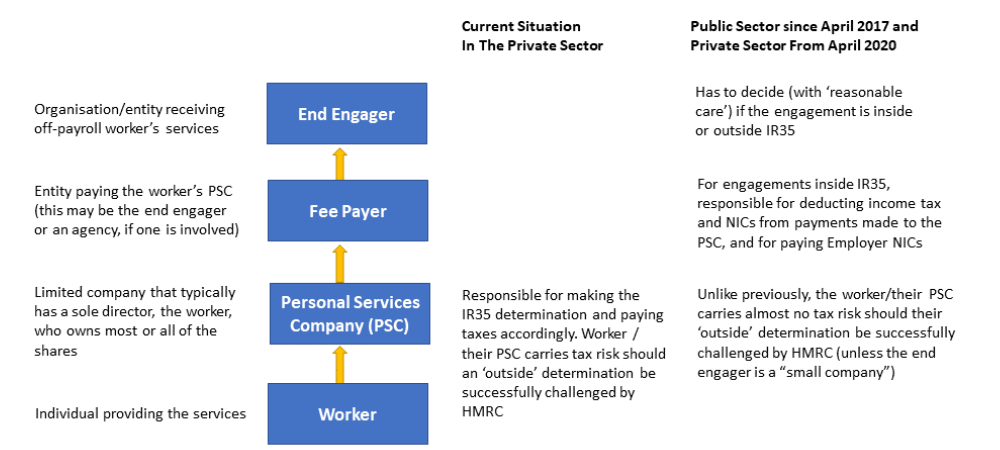

The off-payroll working rules – commonly known as IR35 – are intended to ensure that individuals who work like employees pay broadly the same employment taxes as employees, regardless of the structure they work through. IR35 applies where an individual (the ‘worker’) provides their services through one or more intermediaries (usually limited companies), to another entity (the ‘end engager’).

IR35 was introduced in 2000, with workers (limited company contractors, otherwise known as personal service companies – PSCs) being responsible for making their own IR35 determination and paying their taxes accordingly. In April 2017, the legislation was reformed for those working in the public sector, with the public authorities becoming responsible for deciding whether the worker would have been regarded as an employee for employment tax purposes if they were engaged directly.

In addition, if the worker was deemed to be working like an employee (‘inside IR35’), the entity which paid the worker’s PSC (the ‘Fee Payer’) became responsible for accounting for and paying income tax and NICs under PAYE to HMRC, on behalf of the worker. This was regardless of whether the ‘Fee Payer’ was the public authority itself, or an agent.

As widely anticipated, the following year it was announced that this reform would be extended to engagements in the private sector[1] from 6th April 2020. Estimates of the number of individuals affected range from 170,000 to 900,000 UK-based limited company contractors.

[1] The one exception is ‘small’ companies, who will not be affected by the reform.

At odds with the future of work?

Issues with public sector reforms have been widely reported and included problems with the CEST (‘Check Employment Status for Tax’) determination tool and successful challenges to rulings. There was also a reported talent drain, with workers opting to seek alternative assignments in the private sector, negatively impacting transformation within the public sector.

In some ways it would seem a little incongruous that the government would seek to set obstacles in the path of the future of work. It seems a win-win direction of travel; for organisations that are keen to tap into ‘on demand’ workforces to stay agile and flexible in the midst of changing market demands [2] and for a professional workforce that is increasingly opting to freelance[3].

Perhaps the professional gig economy is a victim of its own success? With predictions ranging from the World Economic forum modelling that the majority of the US workforce will freelance by 2027 and other sources saying 42% of HR professionals plan to engage more contingent workers in the future, its clear to see why the HMRC may be spooked by the impact of this indisputable trend on its coffers. Indeed it believes that less than 10% of PSCs actually complied with their responsibilities, and it estimates that the tax cost could be as much as £1.3bn in 2023/24 [4].

[2] According to Mercer’s latest Global Talent Trends study, 79% of executives expect that contingent and freelance workers will substantially replace full-time employees in the coming years.[3] The vast majority of independent consultants, 86% are satisfied with working as an independent, and are more satisfied than employed consultants with their current professional life.[4] Off-payroll working: How IR35 rules affect the private sector | Legal guidance | Tools | XpertHR.co.uk

From IRate to Action

Its clearly coherent policy for the government to want to identify ‘shielded employment’ and ensure that fair taxation is levied and we agree with this goal; but we also share the scepticism of many about the factors that HMRC believe make some engagements ‘employment -like’ given the financial risks independent consultants take on and wonder at the fairness of being deemed ‘employed’ for tax purposes but not for rights such as holiday and sick pay [5]

Whilst it is fair to say that there have been many shocks in our political landscape over the last year or so and there is lobbying to repeal this controversial reform; it’s now essential in our view that all the stakeholders in the ‘supply chain’ – consultants, clients and firms like ourselves look towards resolving the ongoing ambiguities together and are well into action-planning ahead of April.

As a consulting company we contract with our clients for the completion of project-specific activities and deliverables, i.e. contract for services, not for the provision of a specific person. In general, we engage with our clients through:

- A master services / framework agreement for the provision of consultancy services, in conjunction with

- A statement of work for each project.

Given the nature of the work and the degree of control we have over full service and managed capability consulting projects, we expect the majority to fall ‘outside’ of IR35. However, we do anticipate that some of our interim consulting assignments will be deemed ‘inside’ of IR35 due to client policies or working practices and in these instances this will communicated at the outset and consultants will likely be asked to work through an umbrella company for this.

We welcome the recent HMRC briefing which refers to planned improvements to the CEST tool, now due for release in December 2019, but under current guidance, for an opportunity to be considered ‘outside IR35’, there are 3 main conditions, any of which would deem an engagement to be ‘outside’ of IR35:

- There must be a right of substitution. The consultant can provide a substitute if he/she is unable or unwilling to do the work and the client has no right of veto as long as substitute has the right skills/qualifications. The original consultant must bear the costs of this substitution.

- The client does not supervise, direct or control how the consultant delivers the services . Our consultants will work to the scope, objectives and deliverables agreed between B2E Consulting and the end client, but they will use their own expertise to decide how the work is performed and to some extent, where the work is performed e.g. split between home office and client site working.

- There is no mutuality of obligation. There is no obligation, at the end of the current contract, for the client to offer more work to B2E/the consultant and if more work were offered, there is no obligation for B2E/the consultant to accept such work. Similarly, during the existing contract, there is no obligation for the consultant to provide any services outside of those documented on the Statement of Work; if the client requires different/additional services, these need to be the subject of a change request to the existing contract,

There are other considerations including:

- Part and parcel: Consultants must not be treated as employees and should not receive the same benefits as employees for example they should not attend staff meetings/staff Xmas parties etc and should not use subsidised staff canteens/sports facilities etc.

- Financial Risk: Consultants should demonstrate some financial risk around delivery of the services – e.g. if rework is required, it should be done at the consultant’s own cost and expense.

- Exclusive Service: Nothing in the contracts should prevent the consultant from performing paid work for more than one client concurrently (related to ‘control’).

- Provision of Equipment: Consultant should provide their own business equipment to enable them to deliver the services for which they have been engaged. Although it is accepted that in actual practice, the client may provide a PC from an IT security point of view,

- Being in Business on the Consultant’s Own Account – being VAT registered; having their own PI and PL insurances, having work email address etc.

[5] https://www.qdoscontractor.com/docs/default-source/resources/contractor-guide-to-ir35-reform.pdf

Outlook

Ultimately each client will have a different approach that they will wish to take to IR35 depending on their risk profile and working practices. We are working with them and experts like Qdos to help bring our clients and our consultants more clarity over the coming months.

We foresee a large increase in the use of umbrella companies as a way to respond to this new legislation whilst complying with the new IR35 obligations. We anticipate that the trend towards more flexible working arrangements will continue despite the changes to IR35; clients will still want to maintain a mix of talent within their businesses and therefore demand for flexible talent options will remain.

Sources / Further Reading

Hunts Canlon – Human capital leaders turning to flexible workforce in record numbers

The HR Director – Gig economy booms as war for digital talent intensifies

Consultancy UK – Independents more satisfied with career than employed consultants

Global News Wire – How to be a rock star in the elite expert segment of the gig economy

Personnel Today – Gig professionals on the rise and HR likes it

We Forum – 4 Predictions for the future of work

Business.com – Here’s how small businesses benefit from freelance talent

Accountancy Daily – HMRC clarifies IR35 rules for off-payroll workers

Gov.uk – HMRC issue briefing: Reform of off-payroll working rules

Consultation document: Off-payroll working rules from April 2020.pdf

XpertHR – IR35 – Will the private sector learn the hard way

IT Contracting.com – IR35

Computing.co.uk – Government to forge ahead with IR34 reforms

Contractor Weekly – RBS to stop engaging contractors in IR35 U-turn

Consultancy UK – HMRC’s IR35 change: an opportunity for consulting firms?

Qdos Contractor – Contractor Guide to IR35 Reform

Odgers Interim – IR35 & the private sector

Procorre – Spotlight on IR35 Report

About the author, Maninder Murfin

Maninder joined B2E in 2015 and works with our clients and consultants as a Service Delivery Partner. She also leads the Business Analysis capability talent pool and B2E’s social media activities. Prior to this, Maninder spent nine years with Accenture within its UK Financial Services division, leading and supporting programme workstreams in Change Management, TOM Design, Organisation Design and HR Transformation.

About the author, Maninder Murfin

Maninder joined B2E in 2015 and works with our clients and consultants as a Service Delivery Partner. She also leads the Business Analysis capability talent pool and B2E’s social media activities. Prior to this, Maninder spent nine years with Accenture within its UK Financial Services division, leading and supporting programme workstreams in Change Management, TOM Design, Organisation Design and HR Transformation.